Trading Trend Patterns: A Guide to Understanding and Utilizing Them

Trading trend patterns are an essential aspect of technical analysis used by traders to identify potential market opportunities. These patterns are formed by the movement of prices over time and can provide valuable insights into future price movements. Analyzing these trends allows traders to make well-informed choices regarding the timing of trade entry and exit.

There are several types of trend patterns that traders use to identify potential market opportunities. One of the most popular is the “head and shoulders” pattern, which is formed when a stock’s price rises to a peak (the left shoulder), falls back, rises to a higher peak (the head), falls again, and then rises to a third peak (the right shoulder). Another common pattern is the “double top” or “double bottom” pattern, which occurs when a stock’s price reaches a high or low point twice before reversing direction.

It’s important to note that while trend patterns can be useful in identifying potential market opportunities, they are not foolproof. Market conditions can change quickly, and patterns that have worked in the past may not work in the future. As with any trading strategy, it’s essential to do your research and use sound judgment when making trading decisions based on trend patterns.

Understanding Trading Trend Patterns

As a trader, understanding trading trend patterns is essential to making informed decisions. Trend patterns are a visual representation of the direction in which a stock or any other asset is moving. These trends can be utilized to pinpoint potential purchasing or vending prospects.

Basics of Trend Patterns

Trend patterns are formed by a series of higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend. These patterns can be identified by drawing trend lines on a chart. A trend line is a straight line that connects two or more price points and is used to indicate the direction of the trend.

There exist three primary trend patterns in trading: uptrend, downtrend, and sideways trend. An uptrend is distinguished by a sequence of increasing peaks and troughs, whereas a downtrend is marked by a sequence of decreasing peaks and troughs. A sideways trend, also known as a range-bound market, is characterized by a lack of direction in price movement.

Significance of Trend Lines

Trend lines are crucial in identifying trend patterns and potential trading opportunities. They provide a visual representation of the direction of the trend and can be used to determine entry and exit points for trades.

When drawing trend lines, it is important to connect at least two price points to create a valid trend line. The more price points that can be connected, the stronger the trend line becomes. A break in a trend line can indicate a potential trend reversal or a change in the direction of the trend.

In conclusion, understanding trading trend patterns and trend line patterns is essential to making informed trading decisions. By identifying trend patterns trading and drawing trend lines, traders can determine potential entry and exit points and maximize their profits.

Trend Line Candlestick Patterns

As a trader, one of the most important skills to develop is the ability to identify and read trend line candlestick patterns. These patterns can provide valuable insights into market trends and help you make informed trading decisions.

Identifying Candlestick Patterns

Candlestick patterns are formed by the movement of price over time and can provide insights into market sentiment. There are several common candlestick patterns that traders should be familiar with, including the Doji, Hammer, and Shooting Star.

The Doji is a candlestick pattern that indicates indecision in the market. It is characterized by a small body and long wicks on both ends. The Hammer is a bullish pattern that indicates a potential reversal in the market. It is characterized by a small body and a long lower wick. The Shooting Star is a bearish pattern that indicates a potential reversal in the market. It is defined by a petite physique and an elongated upper shadow.

Reading Candlestick Trends

In addition to identifying candlestick patterns, traders must also be able to read candlestick trends. This involves analyzing the overall direction and momentum of the market.

One way to do this is by looking at the length and direction of the candlestick bodies. If the candlestick bodies are consistently getting longer in one direction, this indicates a strong trend. If the candlestick bodies are getting shorter and the wicks are getting longer, this indicates a weakening trend.

Another way to read candlestick trends is by looking at support and resistance levels. If a candlestick pattern forms at a key support or resistance level, this can indicate a potential reversal in the market.

Overall, trend line candlestick patterns can provide valuable insights into market trends and help traders make informed trading decisions. By learning to identify and read these patterns, traders can improve their chances of success in the market.

Bullish Trend Patterns

As a trader, I always keep an eye out for bullish trend patterns as they can signal a potential uptrend in the market. In this section, I will discuss the characteristics of bullish patterns and how to trade the bull flag pattern.

Characteristics of Bullish Patterns

Bullish patterns are characterized by a series of higher highs and higher lows on a price chart. These patterns indicate a bullish sentiment in the market, where buyers are willing to pay higher prices for the asset. Some common bullish patterns include the ascending triangle, the inverse head and shoulders, and the cup and handle pattern.

Traders can use technical analysis tools such as moving averages and trend lines to identify these patterns. It’s important to note that bullish patterns are not a guarantee of an uptrend, but rather a signal to pay closer attention to the market.

Bull Flag Pattern Trading

The bull flag pattern is a popular bullish pattern that traders often use to identify potential buying opportunities. This pattern is formed when the price of an asset experiences a sharp rise, followed by a period of consolidation in the form of a flag. The flag is typically a downward sloping channel, and the price of the asset usually breaks out of the flag in the direction of the previous uptrend.

Traders can use the bull flag pattern to enter long positions in the market. To do this, they would wait for the price of the asset to break out of the flag and then enter a long position with a stop loss below the flag. It’s important to note that the bull flag pattern can also be seen in the crypto market, where it is used to identify potential buying opportunities.

In conclusion, as a trader, it’s important to be able to identify bullish trend patterns and understand how to trade them. By using technical analysis tools and keeping an eye out for bullish patterns such as the bull flag pattern, traders can potentially profit from uptrends in the market.

Bearish Trend Patterns

As a trader, understanding bearish trend patterns is crucial in identifying potential opportunities for profit. In this section, I will discuss two important aspects of bearish trading trend patterns: identifying bearish trends and bearish trend reversal.

Identifying Bearish Trends

Bearish trading trend patterns are characterized by a series of lower highs and lower lows. This indicates that sellers are in control of the market and that the price is likely to continue its downward trend. One way to identify a bearish trend is to look for a series of lower highs and lower lows on a price chart. Another approach involves utilizing technical indicators like moving averages or the relative strength index (RSI).

Bearish Trend Reversal

Bearish trend reversal occurs when the market shifts from a downward trend to an upward trend. This can be a great opportunity for traders to profit from a potential price increase. One way to identify a potential trend reversal is to look for a bearish trend reversal candlestick pattern, such as the evening star or the bearish engulfing pattern.

It is important to note that trend reversal trading trend patterns are not always accurate and should be used in conjunction with other technical analysis tools. As a trader, it is important to remain vigilant and constantly monitor the market for potential opportunities.

In conclusion, understanding bearish trading trend patterns and trend reversal is essential for successful trading. By using technical analysis tools and keeping a close eye on the market, traders can identify potential opportunities for profit and minimize their risk.

Trading Strategies for Trend Patterns

As a trader, it is important to have a well-defined strategy for trading trend patterns. Trend patterns can provide valuable insights into market movements and can be used to identify potential trading opportunities. In this section, I will discuss some trading strategies for trading trend patterns.

Long-Term vs Short-Term Strategies

There are two main types of trading strategies for trading trend patterns: long-term and short-term. Long-term strategies involve holding positions for an extended period of time, typically weeks or months. Short-term strategies, on the other hand, involve holding positions for a shorter period of time, typically days or even hours.

Long-term strategies are often used by investors who are looking to capitalize on long-term trends in the market. These strategies require patience and discipline, as it can take time for trends to develop and for profits to be realized. Short-term strategies, on the other hand, are often used by traders who are looking to capitalize on short-term fluctuations in the market. These strategies require quick thinking and the ability to make rapid decisions based on market movements.

Risk Management in Trend Trading

Risk management is an important part of any trading strategy, and trend trading is no exception. One way to manage risk in trend trading is to use stop-loss orders. A stop-loss order is an order to sell a security when it reaches a certain price, and it can help limit losses in the event of a sudden market downturn.

Another way to manage risk in trend trading is to diversify your portfolio. By investing in a variety of securities, you can reduce your exposure to any one particular security or market. This can help protect your portfolio from sudden market movements or unforeseen events.

In conclusion, trading trend patterns can be a lucrative strategy for traders and investors alike. By using a well-defined trading strategy and implementing effective risk management techniques, traders can increase their chances of success in the market.

Technical Analysis and Trend Patterns

As a trader, I have found that technical analysis is an essential tool for identifying trading trend patterns. Technical analysis utilizes charts and indicators to recognize trading trend patterns and trends in price fluctuations.

Using Technical Indicators

Technical indicators consist of mathematical computations derived from a security’s price and/or volume. They are used to identify potential trading opportunities by providing signals that a trend may be starting or ending. Some frequently utilized technical indicators comprise moving averages, the relative strength index (RSI), and stochastic oscillators.

Moving averages serve the purpose of smoothing price movements and recognizing trading trend patterns in market trends. They can be used to identify support and resistance levels as well as potential entry and exit points. The RSI is used to identify overbought and oversold conditions in a security. Stochastic oscillators are used to identify potential reversals in a trend.

Chart Analysis Techniques

Chart analysis is another important tool for identifying trading trend patterns. One of the most basic chart patterns is the trend line. A trendline is a linear connection between two or more price points, employed to ascertain the trend’s trajectory. A break in a trend line can indicate a potential reversal in the trend.

Other chart patterns include head and shoulders, double tops and bottoms, and triangles. These trading trend patterns can be used to identify potential entry and exit points as well as the strength of a trend.

In conclusion, technical analysis and chart analysis are important tools for identifying trading trend patterns. By using technical indicators and chart patterns, traders can identify potential trading opportunities and make informed trading decisions.

Advanced Trend Pattern Concepts

Complex Trend Patterns

As traders become more experienced, they may begin to recognize more complex trend patterns. These patterns may involve multiple trend lines or support and resistance levels, and may be more difficult to identify than basic trading trend patterns. However, these patterns can provide valuable insights into market trends and can help traders make more informed trading decisions.

One example of a complex trend pattern is the “double top” or “double bottom” pattern. This pattern occurs when a stock or other asset reaches a high or low point, then retraces and reaches that same point again before reversing direction. This pattern can indicate a potential trend reversal, and traders may use it as a signal to enter or exit a trade.

Another example of a complex trend pattern is the “head and shoulders” pattern. This pattern comprises three peaks, with the central peak, known as the “head,” being taller than the other two, which are referred to as the “shoulders.” This pattern can indicate a potential trend reversal, and traders may use it as a signal to enter or exit a trade.

Combining Trend Patterns with Other Strategies

While trading trend patterns can be powerful tools on their own, they can be even more effective when combined with other trading strategies. For example, traders may use trend patterns in conjunction with technical indicators such as moving averages or relative strength index (RSI) to confirm trend direction.

Traders may also use trend patterns in combination with fundamental analysis, which involves analyzing a company’s financial statements, management, industry trends, and other factors that may affect its stock price. By combining trading trend patterns with fundamental analysis, traders can gain a more complete understanding of market trends and make more informed trading decisions.

In conclusion, advanced trend pattern concepts can provide valuable insights into market trends and help traders make more informed trading decisions. By recognizing complex trading trend patterns and combining them with other trading strategies, traders can gain a more complete understanding of market trends and improve their chances of success.

Case Studies and Real-World Applications

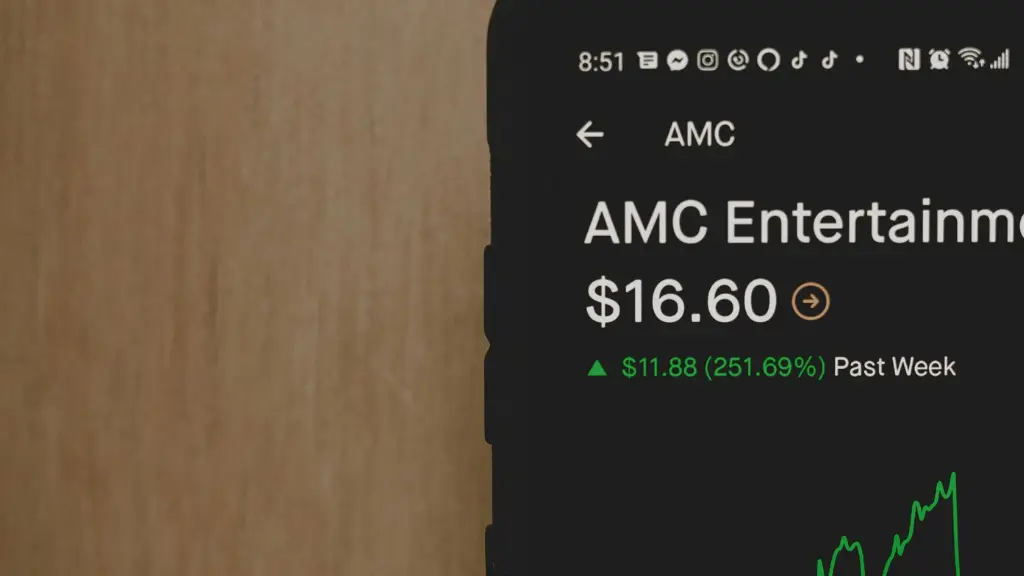

Successful Trend Pattern Trades

As a trader, I have found that one of the best ways to learn abouttrading trend patterns is by analyzing successful trades. One such example is when I noticed a bullish trend forming in the stock market. I observed that the stock of a particular company was consistently rising over a period of time, and I decided to enter a long position. I set my stop loss and take profit levels and waited for the market to move in my favor.

The stock continued to rise, and I was able to exit my trade with a profit. This successful trade taught me the importance of patience and discipline in trading. It also showed me that trading trend patterns can be profitable if you are able to identify them early and execute your trades properly.

Not all trades are successful, and it is important to learn from our failures as well. One such example is when I entered a short position on a currency pair that was in a downtrend. However, I failed to properly analyze the market and did not consider the impact of a major news event that was scheduled to occur.

Conclusion

As a result, the market moved against my position, and I was stopped out with a loss. This trade taught me the importance of conducting proper market analysis and considering all factors that may impact a trade. It also showed me the importance of risk management and setting appropriate stop loss levels.

In conclusion, analyzing successful and unsuccessful trades can provide valuable insights into trading trend patterns. By learning from our successes and failures, we can improve our trading strategies and increase our chances of success in the markets. See also this related article: Crypto Buy Sell Indicator: A Guide to Trading Cryptocurrencies.

Pingback: Ninjacator: The Ultimate Trading Indicator - Trade Center Pro